Learn All About What Is Current Balance On Credit Card

In the world of personal finance, credit cards play a significant role in managing day-to-day expenses and building credit history. However, to make the most of your credit card, it’s crucial to understand various terms and concepts associated with it. One such term is “current balance.” In this article, we’ll delve into what is current balance on credit card means, how it’s calculated, and why it’s important for your financial well-being.

1. Introduction

Make purchases on credit, which means you can spend money even if you don’t have it in your bank account at the moment. However, every credit card comes with a responsibility to manage your expenses wisely, and understanding your current balance is a crucial part of that responsibility.

2. What is Current Balance on a Credit Card?

2.1 Understanding the Basics

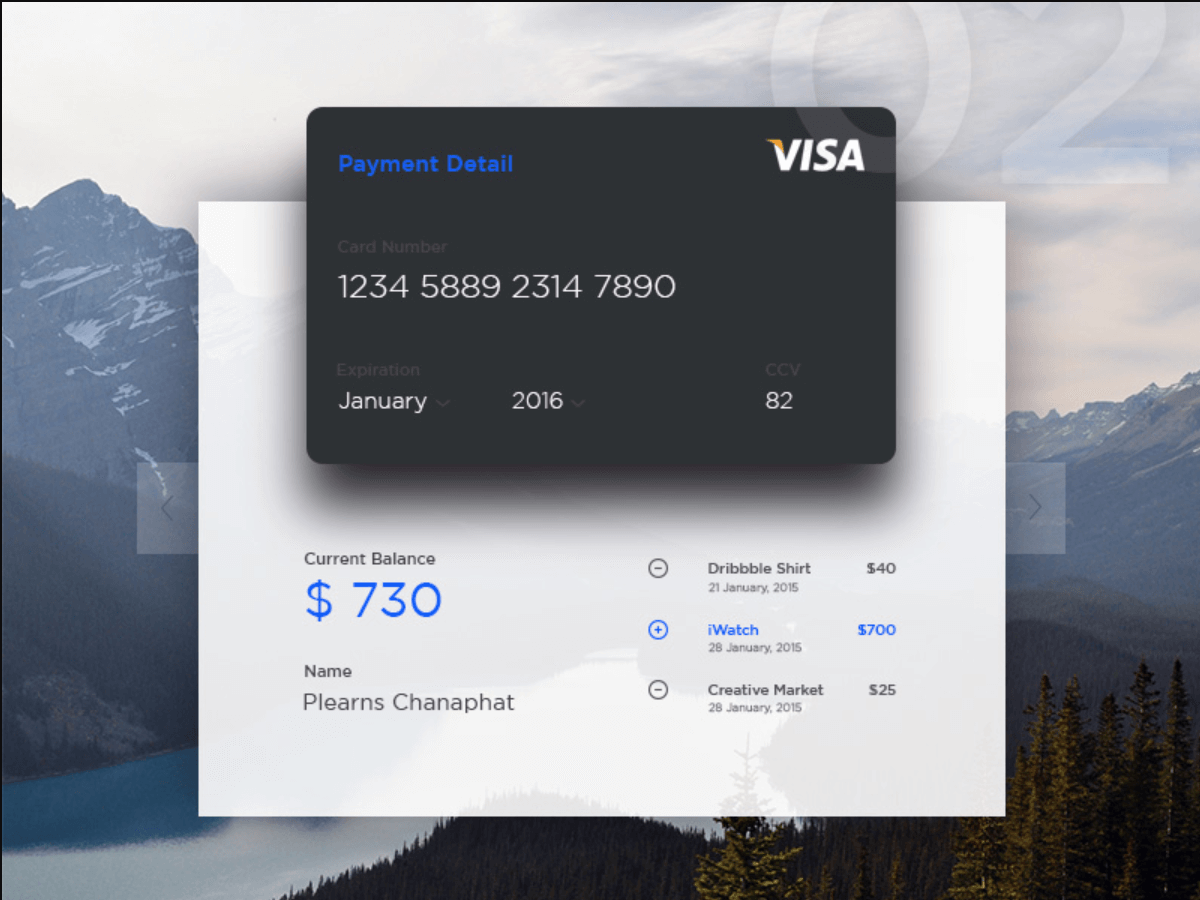

Your current balance on a credit card refers to the total amount of money you owe to the credit card issuer at a specific point in time. This includes both your outstanding purchases and any additional charges such as interest, fees, and penalties. In essence, it’s the snapshot of your credit card account’s financial status at a particular moment.

3. How is Current Balance Calculated?

The calculation of the current balance can be a bit complex, as it involves several components:

- Outstanding Purchases: This is the sum of all the transactions you’ve made using your credit card since the last billing cycle.

- The credit card issuer will apply interest charges to your outstanding balance.

- Fees and Penalties: Any additional fees or penalties, will also be added to your current balance.

To get a clear picture of your current balance, you can check your monthly credit card statement, which breaks down these components.

4. Importance of Monitoring Your Current Balance

4.1 Avoiding Overspending

Keeping a close eye on your current balance is essential to avoid overspending. It allows you to know how much credit you have left before reaching your credit limit. Overspending can lead to high-interest charges and potential financial stress.

4.2 Managing Credit Utilization

Credit utilization is a crucial factor in your credit score calculation. It’s the ratio of your credit card balances to your credit limits. By maintaining a reasonable current balance compared to your credit limit, you can positively impact your credit score.

5. Factors Affecting Your Current Balance

5.1 Credit Card Usage

Your current balance primarily depends on how you use your credit card. If you make large purchases or carry a balance from month to month, your current balance will be higher.

5.2 Interest Rates

Credit card interest rates can significantly affect your current balance. Higher interest rates mean that your outstanding balance accumulates interest charges more quickly.

5.3 Fees and Charges

Additional fees and charges, such as annual fees or cash advance fees, can add to your current balance. It’s essential to be aware of these fees and avoid them when possible.

6. Tips for Maintaining a Healthy Current Balance

- Create a budget and stick to it to prevent overspending.

7. How to Check Your Current Balance

You can check your current balance through various methods, including online banking, mobile apps, or by calling your credit card issuer’s customer service.

8. Common Misconceptions about Current Balance

There are several misconceptions about current balance, such as thinking that it represents your available credit. It’s essential to clear up these misconceptions to make informed financial decisions. Read more…

9. Conclusion

What is current balance on credit card is fundamental to managing your finances responsibly. Following best practices for credit card usage, you can build a strong financial foundation and avoid unnecessary debt.

10. FAQs

Q1: Can I use my entire credit limit without consequences?

A1: While you can use your entire credit limit, it’s not advisable. Maintaining a high credit utilization ratio can negatively impact your credit score.

Q2: How often should I check my current balance?

A2: It’s a good practice to check your current balance regularly, especially before making significant purchases or payments.

Q3: What should I do if I notice an error in my current balance?

A3: If you find an error in your current balance, contact your credit card issuer immediately to rectify the issue.

Q4: Can paying my current balance in full help improve my credit score?

A4: Yes, paying your current balance in full and on time can positively affect your credit score.

Q5: Are there any tools or apps to help me track my credit card balances?

A5: Yes, many financial apps and tools are available to help you monitor your credit card balances and manage your finances effectively.