Learn All About The Average Student Loan Debt in 2020

Countless individuals pursuing higher education. As we delve into the landscape of what is the average student loan debt in 2020, it’s essential to comprehend the intricate web of factors influencing the average student loan debt.

The Average Student Loan Debt in 2020

In the year 2020, student loan debt reached unprecedented levels, marking a critical juncture in the financial journey of many students. Understanding the average student loan debt involves exploring various contributing elements.

Breaking Down the Numbers

To comprehend the average student loan debt, it’s crucial to dissect the figures. By examining debt levels based on degree types and regional disparities, a clearer picture emerges, shedding light on the multifaceted nature of student loans.

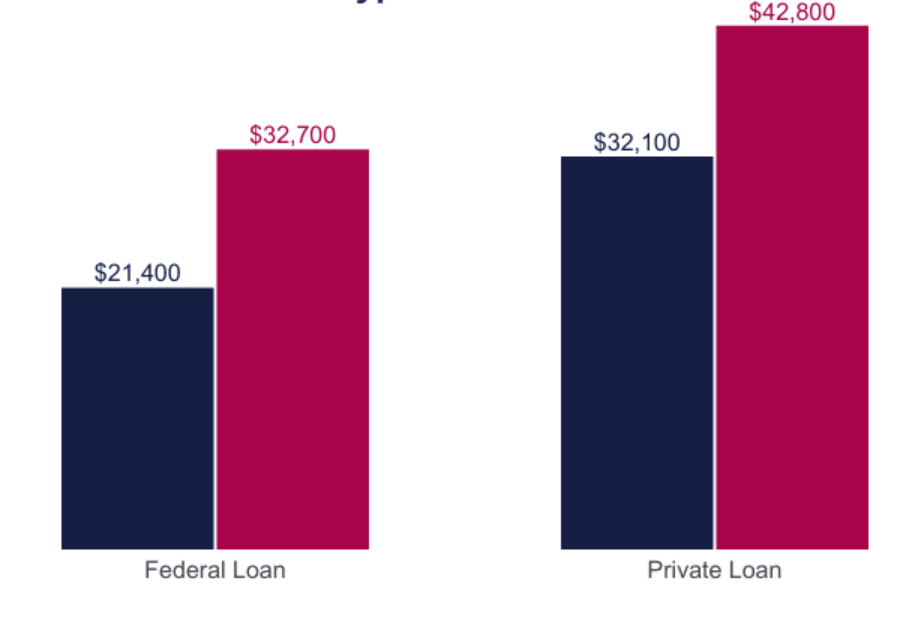

The Rise of Private Loans

While federal student loans are common, the rise of private loans has added complexity to the student debt landscape. We’ll delve into the distinctions between federal and private loans, analyzing the implications for borrowers.

Impact on Graduates

The repercussions of student loan debt extend far beyond the educational realm. Graduates grapple with challenges that go beyond their academic achievements, influencing life decisions and financial stability.

Strategies for Managing Student Loan Debt

For those burdened by student loans, effective management is crucial. Exploring repayment options and offering practical tips for minimizing debt are essential aspects of navigating the challenging terrain of student loans.

Government Initiatives and Policies

Governments have implemented various programs to address the student debt crisis. We’ll analyze the efficacy of existing policies, shedding light on both their successes and limitations.

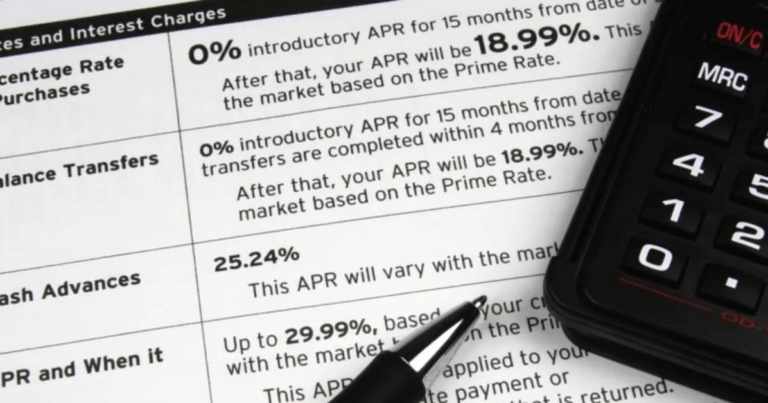

The Role of Interest Rates

Interest rates play a pivotal role in the accumulation of student loan debt. Understanding how interest rates work and implementing strategies to navigate them can significantly impact the overall debt burden.

Alternatives to Traditional Student Loans

Are there alternatives to traditional student loans? Exploring innovative financing options can provide insights into potential solutions that offer a balance between pursuing education and avoiding excessive debt.

Financial Literacy and Student Loan Education

We’ll explore educational initiatives to increase awareness and empower individuals to make informed financial decisions.

Navigating Loan Forgiveness Programs

For those seeking relief from student loans, We’ll delve into the intricacies of these programs, exploring eligibility criteria and application processes.

Post-Graduation Financial Planning

Once the cap and gown are stored away, graduates face the challenge of navigating post-graduation financial realities. This section will provide practical tips for financial planning after graduation while managing student loan obligations.

Public Perception and Awareness

Understanding public perceptions of student loan issues is essential for societal change. As awareness grows, societal attitudes towards student loans transform, which could influence future policies.

The Future of Student Loan Debt

In speculating about the future of student loan debt, we’ll explore potential trends and anticipate policy changes that could reshape the landscape. Predictions will be made to foster a proactive approach to managing student loans. Read more…

Conclusion

In conclusion, what is the average student loan debt in 2020 is a complex issue with far-reaching implications. By grasping the intricacies of student loans, individuals can make informed decisions, and societies can work towards solutions that alleviate the burden.

FAQs:

Q: Are there any new government initiatives to address student loan debt?

- A: Yes, there are ongoing government efforts to address the student loan crisis, including new initiatives aimed at providing relief for borrowers.

Q: What are the advantages of private student loans over federal loans?

- A: Private student loans may offer flexibility but come with higher interest rates. Borrowers should carefully weigh the pros and cons before choosing.

Q: How can graduates effectively manage their student loan debt?

- A: Graduates can manage student loan debt by exploring repayment plans, seeking forgiveness programs, and adopting sound financial planning strategies.

Q: Are there alternatives to traditional student loans for financing education?

- A: Yes, there are alternative financing options, such as scholarships, grants, and income-share agreements, that can help reduce reliance on traditional student loans.

Q: What role does financial literacy play in managing student loans?

- A: Financial literacy is crucial for making informed decisions about student loans, understanding interest rates, and developing effective repayment strategies.