Learn All About what a good credit score for a home loan?

In the complex world of real estate, your credit score plays a pivotal role in securing a home loan. Whether you’re a first-time homebuyer or looking to refinance, understanding what is a good credit score for a home loan is crucial for a successful loan approval.

Introduction

In home financing, your credit score is the gatekeeper to favorable loan terms and interest rates. Let’s delve into the intricacies of credit scores and unveil the secrets behind obtaining an ideal score for your home loan.

What is a Credit Score?

Definition and Components

A credit score is a numerical representation of your creditworthiness, derived from various financial behaviors. Components include payment history, credit utilization, length of credit history, types of credit in use, and new credit accounts.

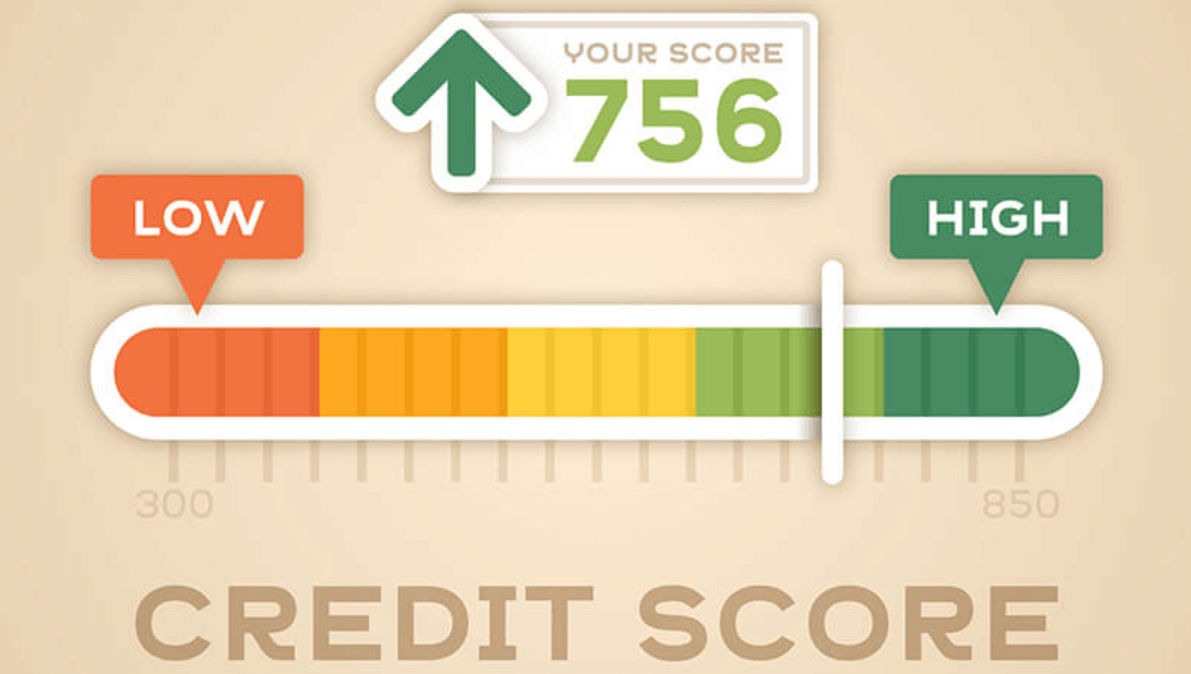

Credit Score Ranges

Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Understanding these ranges is fundamental in gauging your eligibility for a home loan.

Factors Influencing Credit Scores

Numerous factors influence credit scores, including payment history, credit mix, new credit applications, and outstanding debts. Recognizing these factors empowers you to take control of your credit destiny.

The Impact of Credit Score on Home Loans

Minimum Credit Score for a Home Loan

Lenders often set a minimum credit score requirement for home loan approval. Knowing this threshold is the first step in assessing your readiness for homeownership.

Interest Rates Based on Credit Scores

Your credit score directly influences the interest rates offered by lenders. A higher credit score opens doors to lower interest rates, potentially saving you thousands over the life of your loan.

How Credit Score Affects Loan Approval

Beyond interest rates, a good credit score enhances your chances of loan approval. Lenders view higher credit scores as indicative of responsible financial behavior, instilling confidence in your ability to repay the loan.

How to Check Your Credit Score

Importance of Regular Credit Score Checks

Regularly monitoring your credit score is crucial for identifying potential issues and ensuring accuracy. Various online platforms offer free access to your credit report, allowing you to stay informed about your financial health.

Free Credit Report Options

Take advantage of free credit report options to access your credit information. Understanding your credit report is the first step in proactively managing and improving your credit score.

Understanding Credit Reports

Delve into the details of your credit report, analyzing factors such as outstanding debts, payment history, and credit inquiries. Addressing discrepancies and understanding the report’s nuances empowers you to make informed financial decisions.

Improving Your Credit Score

Steps to Boost Your Credit Score

Improving your credit score requires strategic steps, including timely payments, debt reduction, and responsible credit card usage. Implementing these measures gradually enhances your creditworthiness.

Timelines for Credit Score Improvement

Credit score improvement is not instantaneous. Understanding the timelines involved helps set realistic expectations and allows for steady progress toward a higher credit score.

Professional Assistance Options

Consider seeking professional assistance, such as credit counseling services, to accelerate the credit score improvement process. Expert guidance provides personalized strategies for your unique financial situation.

Common Myths About Credit Scores

Dispelling Misconceptions

Separate fact from fiction by dispelling common myths about credit scores. Understanding the truth behind these misconceptions is key to making informed financial decisions.

Factors Not Affecting Credit Scores

Contrary to popular belief, certain factors, such as income and demographic information, do not directly impact your credit score. Unraveling these truths fosters a clearer understanding of credit score dynamics.

The Role of Income in Credit Scores

While income isn’t a direct factor in credit scores, stable income can indirectly contribute to better financial habits, positively influencing your creditworthiness.

Tips for Maintaining a Good Credit Score

Responsible Credit Card Usage

Strategically using credit cards and maintaining low balances contribute to a positive credit score. Responsible credit card management is a powerful tool in your credit improvement arsenal.

Timely Payments and Debt Management

Consistently making on-time payments and actively managing outstanding debts are cornerstones of maintaining a good credit score. Prioritize financial responsibilities to uphold your creditworthiness.

Avoiding Credit Pitfalls

Identify and avoid common credit pitfalls, such as maxing out credit cards and neglecting payment due dates. Proactive measures shield your credit score from unnecessary harm.

Case Studies: Success Stories in Home Loan Approval

Real-Life Examples of Individuals Improving Credit Scores

Explore inspiring real-life stories of individuals who successfully improved their credit scores to secure home loans. These case studies provide actionable insights for your own credit journey.

How Higher Credit Scores Impacted Their Home Loan Journey

Discover the tangible benefits of higher credit scores on the home loan approval process. From lower interest rates to increased negotiation power, these success stories showcase the rewards of credit score diligence.

Lessons Learned from Success Stories

Extract valuable lessons from success stories, understanding the importance of perseverance, financial discipline, and strategic credit management.

Credit Score and Down Payments

Relationship Between Credit Scores and Down Payment Requirements

Examine the relationship between credit scores and down payment requirements. A higher credit score may enable you to negotiate lower down payments, easing the financial burden of homeownership.

Negotiating Down Payments with a Good Credit Score

With a good credit score, explore opportunities to negotiate down payments with lenders. This leverage can contribute to a more favorable homebuying experience.

Case Studies on Down Payment Variations

Analyze case studies illustrating how credit scores influenced down payment variations. Understanding these real-world scenarios aids in crafting your approach to down payments.

Expert Advice on Credit Scores and Home Loans

Insights from Mortgage Experts

Tap into the knowledge of mortgage experts who share insights on credit score management and its impact on home loans. Expert advice provides a roadmap for navigating the intricacies of the mortgage landscape.

Industry Recommendations for Credit Score Improvement

Explore industry recommendations for credit score improvement. From financial habits to credit utilization strategies, these recommendations offer actionable steps toward a better credit score.

Long-Term Credit Score Strategies

Gain perspective on long-term credit score strategies, considering the evolving nature of credit assessments. Future-proof your creditworthiness by implementing sustainable financial practices.

The Future of Credit Scores in Home Loan Approvals

Evolving Trends in Credit Score Assessment

Stay ahead of the curve by exploring evolving trends in credit score assessment. Technological advancements and changing industry dynamics shape the future landscape of creditworthiness.

Technological Advancements and Credit Scoring

Evaluate the role of technological advancements in credit scoring. From machine learning algorithms to innovative data sources, technology continues to redefine how credit scores are calculated.

Predictions for the Future

Anticipate the future of credit scores in home loan approvals. Industry predictions illuminate potential changes and advancements, preparing you for what lies ahead. Read more…

Conclusion

In wrapping up our exploration, it’s evident that a good credit score is not just a number but a powerful tool in your homeownership journey. As you embark on the path to a home loan, remember the significance of informed decision-making, financial discipline, and ongoing credit score management.

FAQs

- What is the minimum credit score needed for a home loan?

- Lenders often require a minimum credit score of 620 for conventional loans, but higher scores can lead to better terms.

- How frequently should I check my credit score?

- Regularly monitoring your credit score is recommended, at least once a month, to stay informed about any changes or discrepancies.

- Can I improve my credit score quickly?

- While credit score improvement takes time, consistent and strategic efforts can lead to noticeable improvements within a few months.

- Do all lenders use the same credit scoring model?

- No, different lenders may use various credit scoring models, but most rely on FICO scores as a common benchmark.

- Is it possible to get a home loan with a low credit score?

- It’s challenging but not impossible. Some lenders specialize in working with individuals with lower credit scores, though terms may be less favorable.