Learn All About What Banks Offer a Secured Credit Card

In today’s financial world, having a good credit score is crucial for various reasons, such as But what if you have a limited or poor credit history? What banks offer a secured credit cards comes into play, and choosing the right bank for your secured credit card is essential.

What is a Secured Credit Card?

This deposit serves as collateral and determines your credit limit. Unlike traditional credit cards, secured cards are designed for individuals with limited or damaged credit. They offer a way to build or rebuild your credit history responsibly.

Why Choose a Secured Credit Card?

Advantages of Secured Credit Cards

- Credit Building: Secured credit cards help you establish or repair your credit history by reporting your payment activity to credit bureaus.

- Accessible: They are easier to qualify for, making them a great option for those with poor or no credit.

- Financial Discipline: Using a secured credit card encourages responsible spending and payment habits.

Who Can Benefit from Them?

- Students looking to build credit

- Individuals with no credit history

- People with a low credit score

- Those recovering from past financial mistakes

Factors to Consider When Choosing a Bank

Before applying for a secured credit card, it’s essential to consider a few crucial factors.

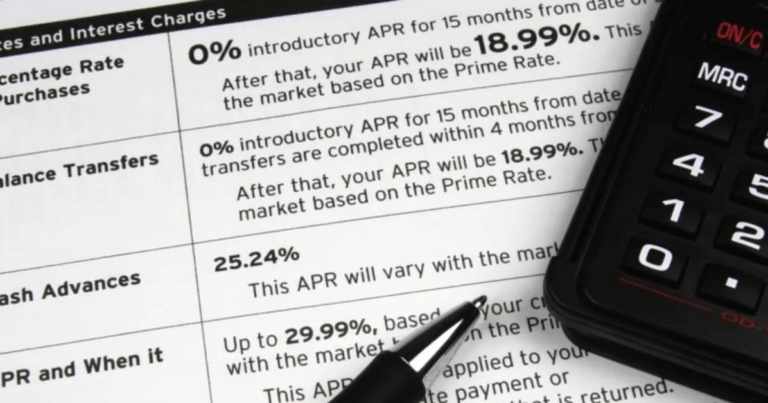

Interest Rates and Fees

Different banks offer different interest rates and fee structures. Compare these charges to ensure you get the best deal for your financial situation.

Credit Reporting and Building

Ensure that the bank reports your payment history to major credit bureaus. This is crucial for building or rebuilding your credit.

Security Deposit Requirements

Determine the minimum and maximum security deposit requirements set by the bank.

Top Banks Offering Secured Credit Cards

Several banks offer secured credit cards. Here are three top contenders:

Bank A

Bank A is renowned for its excellent customer service and a variety of financial products. Their secured credit card offers competitive interest rates and a straightforward application process.

Bank B

Bank B stands out with its low fees and a user-friendly mobile app. Their secured credit card is a popular choice for those new to credit.

Bank C

Bank C is known for its strong emphasis on credit education. Their secured credit card is an excellent choice for individuals looking to build their credit knowledge.

Bank A Secured Credit Card

Features and Benefits

- Low annual fee

- Competitive interest rate

- Option to upgrade to an unsecured card

- Online account management

Application Process

- Visit the Bank A website.

- Complete the online application form.

- Submit your security deposit.

- Wait for approval.

Bank B Secured Credit Card

Features and Benefits

- No annual fee

- Low security deposit requirement

- Cashback rewards on select purchases

- 24/7 customer support

Application Process

- Download the Bank B mobile app.

- Complete the in-app application.

- Fund your security deposit.

- Receive a virtual card while waiting for the physical one.

Bank C Secured Credit Card

Features and Benefits

- Credit education resources

- Zero liability for unauthorized charges

- Credit limit increase with responsible use

- Mobile app for easy account management

Application Process

- Schedule an appointment at a local Bank C branch.

- Meet with a financial advisor to discuss your financial goals.

- Complete the application in person.

- Fund your security deposit on the spot.

How to Apply for a Secured Credit Card

Applying for a secured credit card is a straightforward process. Follow these steps for a successful application:

- Choose a bank that suits your needs.

- Complete the bank’s application form, whether online or in person.

- Fund your security deposit as per the bank’s requirements.

- Wait for the bank’s decision. Approval times may vary.

Tips for a successful application:

- Double-check your application for accuracy.

- Ensure you meet the bank’s credit criteria.

- Have all necessary documents on hand.

Using a Secured Credit Card Wisely

While secured credit cards can be a great tool for credit building, using them responsibly is essential. Here are some tips:

- Pay your bill on time and in full each month.

- Keep your credit utilization low.

- Monitor your credit reports for accuracy.

- Gradually transition to an unsecured card as your credit improves. Read more…

Alternatives to Secured Credit Cards

If secured credit cards aren’t the right fit for you, consider these alternatives:

Unsecured Credit Cards

These traditional credit cards don’t require a security deposit but may have stricter approval requirements. They often offer rewards and benefits.

Credit-Building Loans

Credit-building loans are installment loans designed to help you establish credit. They involve borrowing a set amount and making fixed monthly payments.

Conclusion

What banks offer a secured credit card are a valuable tool for individuals looking to build or rebuild their credit. You can set yourself up for financial success by choosing the right bank and card. Responsible use and patience are key when using secured credit cards to improve your creditworthiness.