Learn All About what is a good apr for a credit card

They provide convenience and flexibility when making purchases, but it’s essential to understand the terms and conditions associated with them. One crucial aspect is the Annual Percentage Rate (APR), which affects the cost of borrowing on your credit card. In this article, we will delve into what is a good apr for a credit card and provide tips for finding the best credit card options available.

Understanding APR for Credit Cards

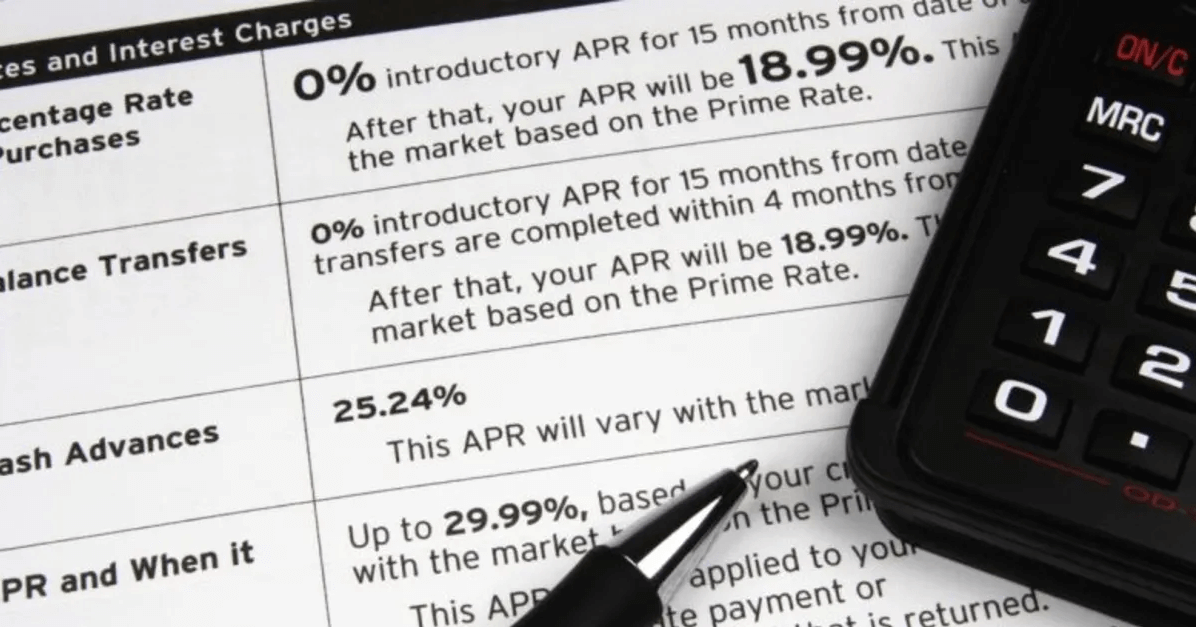

APR is a measure of the cost of borrowing expressed as a yearly interest rate. When it comes to credit cards, the APR represents the interest rate you’ll be charged on any outstanding balances carried over from month to month. It’s important to note that credit cards may have different APRs for purchases, balance transfers, and cash advances. The APR can significantly impact the overall cost of using your credit card, making it a crucial factor to consider before applying for a card.

What is a Good APR for a Credit Card?

what is a good apr for a credit card is relative and depends on various factors. In general, lower APRs are desirable as they result in lower interest charges when carrying a balance. A typical good APR for a credit card falls within the range of 13% to 18%. However, it’s worth noting that individuals with excellent credit may qualify for credit cards with APRs below 13%. On the other hand, those with average or fair credit may have to settle for APRs slightly above the average range.

Tips for Finding a Credit Card with a Good APR

Finding a credit card with a good APR requires careful consideration and comparison.

1. Check your credit score

Before applying for a credit card, it’s crucial to know your credit score. This information will give you an idea of the type of APR you may qualify for. If you have excellent credit, you’ll have a higher chance of securing a credit card with a lower APR.

2. Research credit card options

Take the time to research different credit card options available in the market. Look for credit cards specifically designed for individuals with good credit scores. Many online platforms offer tools that allow you to compare various credit cards and their associated APRs.

3. Consider introductory APR offers

Some credit cards offer introductory APRs, which are lower than the standard APR for a certain period. These offers can be advantageous if you plan to make a significant purchase or transfer balances from high-interest cards. However, be mindful of the APR that will apply once the introductory period ends.

4. Read the fine print

Pay close attention to the APRs, including any applicable penalties or fees.

5. Negotiate with credit card issuers

If you have a good credit history and a solid payment record, you may have the leverage to negotiate a lower APR with credit card issuers. Contact the issuer directly and inquire about the possibility of reducing the APR. While not guaranteed, it’s worth exploring this option to potentially secure a better rate.

Pros and Cons of Low and High APRs

Both low and high APRs come with their own set of advantages and disadvantages. Let’s explore them further:

Low APR

- Pros:

- Lower interest charges on balances carried over month to month

- More manageable for individuals who tend to carry a balance

- Greater affordability for long-term borrowing

- Cons:

- May require a good credit score for eligibility

- Other fees or limitations may offset the benefits

High APR

- Pros:

- Easier to qualify for individuals with fair or average credit

- Potential rewards or benefits associated with the credit card

- Cons:

- Higher interest charges on balances carried over month to month

- Can be costly for individuals who frequently carry a balance. Read more…

How to Improve Your Chances of Getting a Good APR

While APRs are influenced by factors beyond your control, there are steps you can take to improve your chances of securing a credit card with a good APR:

- Maintain a good credit score by making timely payments and keeping credit card utilization low.

- Minimize credit card applications to prevent multiple inquiries, which can negatively impact your credit score.

- Regularly review your credit reports and dispute any inaccuracies to ensure your credit history is accurate and up-to-date.

- Pay attention to your debt-to-income ratio and work towards reducing any outstanding debts.

Conclusion

When choosing what is a good apr for a credit card, understanding the APR is crucial to make an informed decision. A good APR for a credit card depends on various factors, including your creditworthiness and the prevailing market conditions. By researching credit card options, considering your credit score, and negotiating with credit card issuers, you can increase your chances of securing a credit card with a favorable APR.

FAQs

- What does APR stand for?

- APR stands for Annual Percentage Rate.

- Can APR change over time?

- Yes, APRs can change over time based on various factors, including the card issuer’s policies and market conditions.

- Is a lower APR always better?

- Generally, a lower APR is more favorable as it reduces the overall cost of borrowing. However, other factors such as fees and rewards should also be considered.