Learn All About What Is Balance Transfer Fee for Credit Card

Outline:

- Introduction

- Understanding Balance Transfers

- What Is a Balance Transfer Fee?

- How Does the Balance Transfer Fee Work?

- Factors to Consider When Evaluating Balance Transfer Fees

- Finding Credit Cards with Low or No Balance Transfer Fees

- Pros and Cons of Balance Transfer Fees

- Tips for Minimizing the Impact of Balance Transfer Fees

- Conclusion

- Frequently Asked Questions (FAQs)

When it comes to managing credit card debt, many individuals look for strategies to reduce their interest payments and simplify their finances. One popular method is utilizing balance transfers. However, before taking advantage of this option, it’s essential to understand the concept of balance transfer fees and how they can affect your financial situation. In this article, we will explore what is balance transfer fee for credit card are, how they work, and provide tips for minimizing their impact.

Understanding what is balance transfer fee for credit card

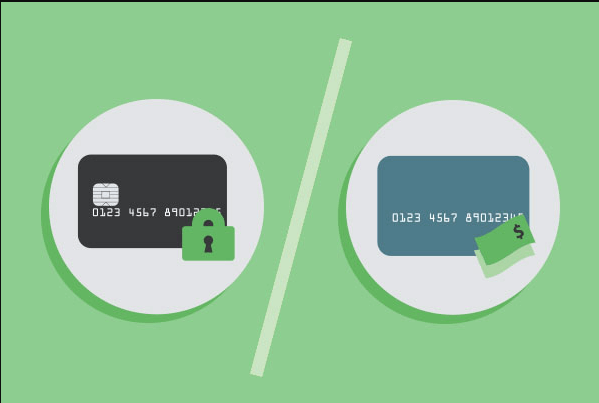

Before diving into what is balance transfer fee for credit card, let’s quickly grasp the concept of balance transfers themselves. A balance transfer involves moving your existing credit card debt from one card to another, typically with the aim of obtaining a lower interest rate or more favorable terms. This process can help individuals consolidate their debt and potentially save money on interest payments.

What Is a Balance Transfer Fee?

A balance transfer fee is a charge imposed by credit card issuers when you transfer your outstanding balance from one card to another. It is usually calculated as a percentage of the amount being transferred. The fee is applied upfront and is typically added to the total balance of the new credit card.

How Does the Balance Transfer Fee Work?

When you initiate a balance transfer, the new credit card company will assess a balance transfer fee. For example, if the fee is 3% and you transfer a balance of $5,000, you would incur a fee of $150. This fee will be added to the balance of your new credit card, increasing the total amount you owe. It’s important to note that the fee is separate from the interest rate on the new card.

Factors to Consider When Evaluating Balance Transfer Fees

When evaluating balance transfer fees, it’s crucial to consider a few factors to make an informed decision:

- Percentage Fee: Different credit card issuers may charge varying percentages as balance transfer fees. Compare the fees associated with different cards to find the most cost-effective option.

- Introductory Offers: Some credit cards offer promotional periods with no or reduced balance transfer fees. Take advantage of these offers to minimize or eliminate the fee altogether.

- Interest Rates: Consider the interest rates of the new credit card after the introductory period ends. A low fee may be less significant if the interest rate is significantly higher than your current card.

- Credit Limit: Ensure that the credit limit of the new card is sufficient to accommodate your transferred balance, including the transfer fee.

Finding Credit Cards with Low or No Balance Transfer Fees

To find credit cards with low or no balance transfer fees, you can follow these steps:

- Research different credit card issuers and compare their balance transfer fees.

- Look for promotional offers with reduced or waived balance transfer fees.

- Consider credit cards that offer a 0% introductory APR on balance transfers for a certain period.

- Read reviews and compare the overall benefits and terms of the credit cards you are considering.

Pros and Cons of Balance Transfer Fees

Balance transfer fees come with advantages and disadvantages. Let’s explore them:

Pros:

- Potential cost savings on interest payments

- Simplification of debt management through consolidation

- Ability to pay off debt faster with lower interest rates

Cons:

- Upfront cost of the balance transfer fee

- Limited promotional periods for reduced or waived fees

- Potential impact on credit score due to opening a new credit account

Tips for Minimizing the Impact of Balance Transfer Fees

Here are some tips to minimize the impact of balance transfer fees:

- Do the Math: Calculate whether the potential interest savings outweigh the balance transfer fee.

- Pay Off the Balance Promptly: Aim to pay off the transferred balance as quickly as possible to minimize interest charges.

- Avoid New Purchases: To focus on debt repayment, refrain from using the new credit card for additional purchases.

- Stick to the Plan: Create a budget and repayment strategy to ensure you stay on track with your debt reduction goals.

- Read the Fine Print: Understand the terms and conditions of the balance transfer offer, including any potential changes in interest rates or fees. Read more…

Conclusion

What is balance transfer fee for credit card play a significant role in the credit card industry and can impact your financial decisions. While they can provide opportunities for interest savings, it’s essential to consider various factors before making a decision. By understanding how balance transfer fees work and following the tips mentioned above, you can make an informed choice that aligns with your financial goals.

Frequently Asked Questions (FAQs)

- Do all credit cards charge balance transfer fees? No, not all credit cards charge balance transfer fees. Some offer promotional periods with reduced or waived fees.

- Will a balance transfer affect my credit score? A balance transfer may have a temporary impact on your credit score. Opening a new credit account and closing the old one can affect factors such as credit utilization and length of credit history.

- Are balance transfer fees negotiable? In some cases, credit card issuers may be willing to negotiate or waive balance transfer fees. It’s worth reaching out to discuss options with the issuer.

- Can I transfer balances from multiple credit cards to one new card? Yes, depending on the credit limit of the new card, you can transfer balances from multiple credit cards onto a single card.