Learn All About What Is the Highest Credit Card Limit?

In today’s fast-paced financial world, They offer convenience, security, and the flexibility to make purchases and pay bills. One common question that often arises is, “What is the highest credit card limit?” In this article, we will delve into this intriguing aspect of credit cards, exploring the factors that determine credit limits, and providing insights into how you can secure a higher card limit for yourself.

Understanding Credit Limits

What is a Credit Limit?

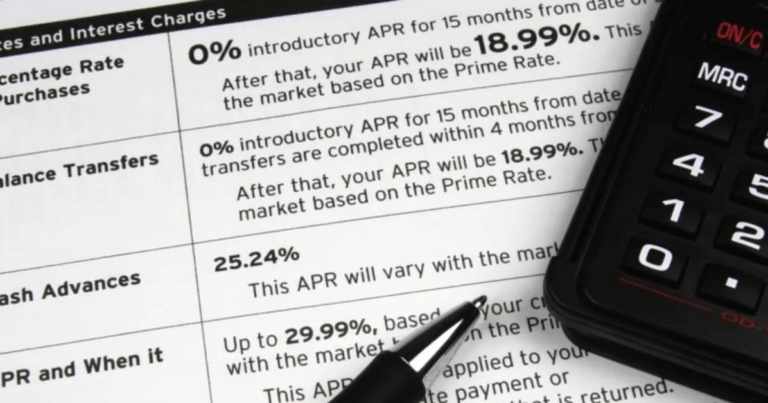

To begin, let’s define what a credit limit is. To your credit card without incurring penalties or being declined. It represents the trust a financial institution places in your ability to repay borrowed funds.

Factors Influencing Card Limits

Several factors play a pivotal role in determining your card limit:

1. Credit Score

A higher credit score signifies responsible credit management and often leads to a higher credit limit.

2.Credit History

A lengthy and positive credit history can boost your chances of securing a higher card limit. Consistent, on-time payments and responsible credit usage are key.

3. Existing Debt

Lenders consider your existing debt obligations. High levels of outstanding debt may limit your card limit.

Get a What is the highest credit card limit

Credit limits, let’s explore how you can increase your credit limit:

1. Improve Your Credit Score

Work on improving your credit score by making timely payments and reducing outstanding debts.

2. Request a Credit Limit Increase

Ensure that you have a valid reason and a solid payment history to support your request.

3. Increase Your Income

A higher income can make you eligible for a higher card limit. Look for opportunities to boost your earnings. Read more…

Conclusion

In conclusion, what is the highest credit card limit you can attain depends on various factors, including your credit score, income, credit history, and existing debt. To secure a higher card limit, focus on improving your creditworthiness, making responsible financial decisions, and exploring options like requesting a credit limit increase or applying for a new card. By understanding the dynamics of credit limits, you can make informed choices to manage your finances more effectively.

FAQs

1. Can I have multiple credit cards with high credit limits?

Yes, having multiple credit cards with high credit limits is possible, but managing them responsibly to avoid financial strain is essential.

2. Does a higher credit limit mean I should spend more?

Not necessarily. While a higher credit limit provides flexibility, it’s crucial to maintain responsible spending habits and avoid accumulating debt.

3. How often can I request a credit limit increase?

You can typically request a credit limit increase every six months, but it may vary depending on your credit card issuer’s policies.

4. Are there any downsides to having a high credit limit?

One potential downside is the temptation to overspend. It’s essential to exercise discipline and use your credit wisely.

5. Can my credit limit decrease over time?

Credit card issuers can lower your credit limit if they perceive increased credit risk, such as missed payments or excessive debt on other accounts.