Learn All About What to Use Credit Card For

In today’s financial landscape, credit cards have become integral to managing one’s finances. They offer convenience, security, and a range of benefits, making them a versatile tool for various financial transactions. But what should you use your credit card for? In this article, we will explore the different aspects of what to use credit card for usage and guide you on making the most of this financial tool.

The Role of Credit Cards

Credit cards serve as a flexible and convenient payment method. Unlike cash or debit cards, they allow you to make purchases and pay for services without needing immediate funds. Let’s delve into various scenarios where credit cards can be beneficial.

Everyday Expenses and Credit Cards

Credit cards can be used for everyday expenses like groceries, dining out, and shopping. They eliminate the need to carry large sums of cash and provide a detailed spending record.

Building Credit History

One significant advantage of using credit cards is their impact on your credit history. Timely payments and responsible credit card usage can boost your credit score, which is essential for obtaining loans or mortgages.

Rewards and Perks

Many credit cards offer rewards and perks, including cashback, travel points, or discounts on specific purchases. By using your credit card strategically, you can earn these benefits.

Emergency Situations

Credit cards can be a lifesaver in emergencies. A credit card can provide a safety net, whether it’s a medical crisis, unexpected car repairs, or a last-minute flight.

Convenience and Security

Credit cards offer a high level of convenience. They can be used for online shopping, reservations, and subscriptions, ensuring that your transactions are secure and protected.

Managing Finances with Credit Cards

To make the most of your credit card, it’s crucial to manage your finances effectively.

Tips for Responsible Credit Card Use

Responsible card use includes paying your bills on time, avoiding excessive debt, and staying within your credit limit. It’s about using your credit card as a financial tool rather than a source of endless funds.

Paying Off Balances

Carrying a balance on your credit card can lead to high interest charges. Whenever possible, pay off the full balance each month to avoid accumulating debt.

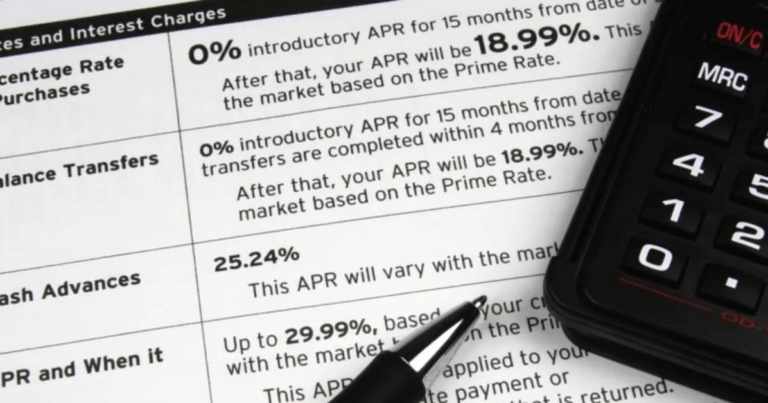

Avoiding High-Interest Debt

Credit cards often come with high interest rates. Avoid your card for cash advances or making purchases you cannot pay off in a reasonable time frame.

Monitoring Credit Card Statements

Regularly reviewing your card statements helps you keep track of your spending and identify any unauthorized or fraudulent transactions.

Credit Score Impact

Your card usage has a direct impact on your credit score. Maintaining a good credit score is crucial for future financial endeavours.

Protecting Against Fraud

Using cards online or at unfamiliar places can expose you to potential fraud. Stay vigilant and take necessary precautions to protect your card information. Read more…

Conclusion

In conclusion, what to use credit card for are versatile financial tools that can be used for a wide range of purposes. From daily expenses to building credit history and enjoying rewards, they offer numerous advantages when used responsibly. However, it’s vital to remember that with great power comes great responsibility. Use your cards wisely, and they can be a valuable asset in your financial portfolio.

FAQs

- Is it a good idea to use cards for everyday expenses?

- Using cards for daily expenses can be convenient, but managing your spending responsibly is essential to avoid accumulating debt.

- How can I build a good credit history with my card?

- Paying your card bills on time and in full can help build a positive credit history.

- What are the potential drawbacks of using cards for emergencies?

- High interest rates and potential debt accumulation are drawbacks of using cards in emergencies.

- What should I do if I notice a suspicious transaction on my card statement?

- If you suspect fraud or unauthorized activity, immediately contact your card issuer to report and resolve the issue.

- How can I protect my card information when using it online?

- To protect your card information online, ensure you only make transactions on secure and reputable websites and regularly monitor your statements for any unusual activity.