What Is Credit Card 101: Everything You Need to Know

Are you new to the world of credit cards? Do terms like APR, balance transfer, and rewards programs leave you feeling confused and overwhelmed? Don’t worry – we’ve got you covered! In this comprehensive guide what is credit card, we’ll break down everything you need to know about how they work, how to use them responsibly, and how to make the most of their benefits. Whether you’re a college student just starting out or a seasoned consumer looking for expert tips and tricks, this post has something for everyone.

What is credit card?

A credit card is an electronic payment system that allows a person to borrow money up to a certain limit in order to purchase goods or services. The cardholder pledges to repay the debt with interest and, if the account is in good standing, the creditor may give the cardholder a corresponding credit limit increase or even a line of credit. What is credit card are essential for everyday spending and can help consumers build or rebuild their credit history.

There are several types of credit cards: store cards, gas cards, airline miles cards, restaurant gift certificates, and more. Store cards generally offer 0% APR on purchases and no annual fees, but they may not have rewards programs. Gas cards give users discounts on gasoline at participating stations; airline miles cards allow holders to earn miles for every dollar spent on flights and hotel stays; restaurant gift certificates can be used at any establishment that accepts them; and more.

What are the benefits of having a credit card?

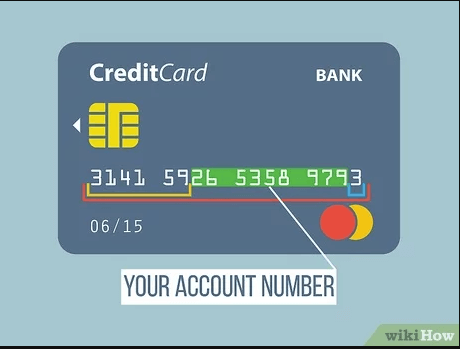

A credit is a plastic card with a magnetic strip that stores your identifying information and credits your account for purchases. When you use your card, the store records the sale as if you had paid with cash. This means that you can build up your credit score by using a credit card responsibly.

Credit also comes in handy when you need to borrow money. A credit card allows you to borrow funds up to a certain limit without paying interest on them. If you can pay off your balance each month, this will help improve your credit score even more.

Finally, some people may find that they need credit to get approved for certain types of loans. For example, if you want to buy a car or take out a loan to purchase a home, having a good credit score is important. A good credit score means that the lender is more likely to approve your request.

How to use a credit card

If you have ever used a credit card, chances are you are familiar with the basic steps of using one.

1. Decide what kind of card you want. You can use a regular credit card or a credit card with a rewards program.

2. Get your credit score and history. This information is used to calculate your interest rate and other terms of the loan.

3. Open your account and complete the required paperwork. Funds may be transferred from your bank account to your new card immediately, depending on the issuer’s policy.

4. Make sure you keep up with payments and reviews your account regularly to stay in good standing with the lender.

How to avoid getting into debt with your credit card

If you want to avoid getting into debt with your credit card, here are some tips:

1. Know Your Limits. Credit come with set limits on how much you can spend each month. Make sure you know what those limits are so that you don’t fall over them accidentally.

2. Be Responsible With Your Spending. Don’t use your card to buy things you can’t afford right away – wait until you have the money saved up first. This way, you won’t get caught in a cycle of debt where you constantly need to borrow more money to cover your expenses

3. Stick To A Budget. If you want to stick to a budget and avoid getting into debt, make sure that every dollar goes towards approved expenses – not stuff that isn’t necessary yet. Read more…

Conclusion

It can be hard to know what to do when it comes to what is credit card. In this article, we are going to outline everything you need to know about credit cards and how they work. Hopefully, this will help put your worries at ease and leave you with a better understanding of the basics behind card usage. Next time you are shopping for a new credit card or signing up for a new one, take some time to read through our guide so that you have