What Is Loan Disclosure: What You Need to Know

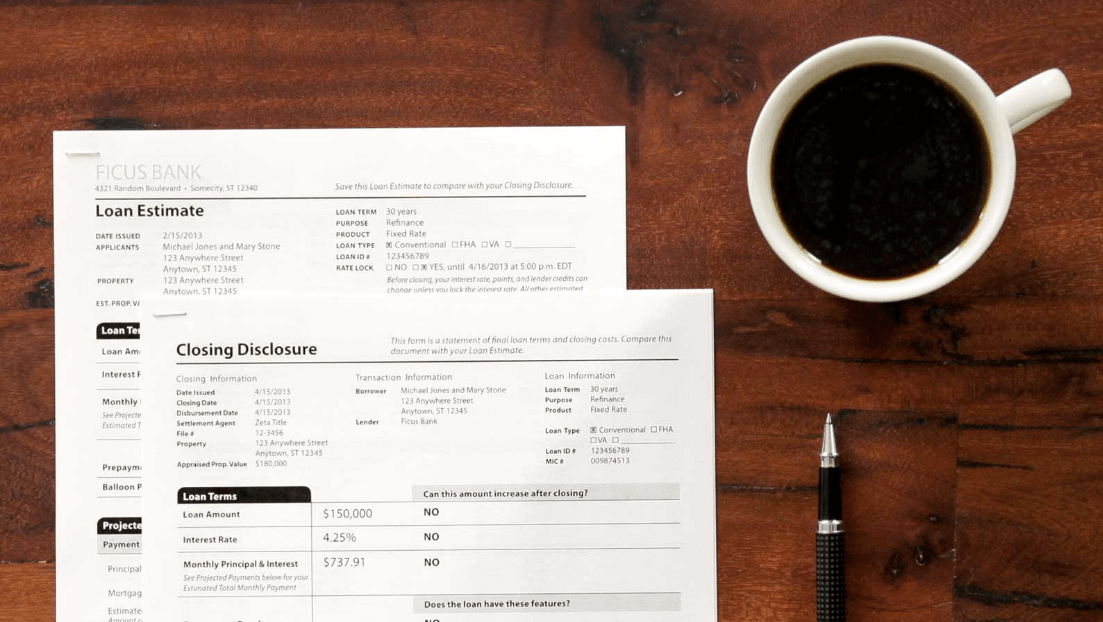

Are you considering taking out a loan? Whether it’s for personal or business use, one thing you need to be familiar with is the Loan Disclosure Statement. This is an important document that outlines all the essential details of your loan agreement. It can help you make informed decisions and avoid any surprises down the line. In this blog post, we’ll go over everything you need to know about What is Loan Disclosure Statements – what they are, what information they contain when they’re required, and how you can obtain one. So let’s get started!

What is Loan Disclosure Statement?

A Loan Disclosure Statement is a legal document that contains all the important information about a loan. It provides detailed information about the terms and conditions of your loan, including the interest rate, fees, and repayment schedule. This statement is designed to help borrowers understand their rights and responsibilities under the loan agreement.

What is Loan Disclosure Statement also lists any penalties or charges that may be incurred if you fail to meet your repayment obligations. By reading this statement carefully, you can make sure that you fully understand what you’re getting into before signing on the dotted line.

In addition to helping borrowers make informed decisions about their loans, Loan Disclosure Statements are also required by law in many jurisdictions. These statements ensure transparency between lenders and borrowers by providing clear disclosures of all relevant terms and fees associated with borrowing money.

What Information is Included in a Loan Disclosure Statement?

A loan disclosure contains all the important details about a loan, including its terms and conditions. This document is required by law to be provided to borrowers before they agree to take out a loan.

One of the most critical pieces of information in a loan disclosure statement is the interest rate. The interest rate determines how much extra you will pay on top of what you borrow from your lender as compensation for using their funds.

Additionally, this statement includes any fees or charges associated with taking out a particular type of loan. These may include origination fees, application fees, late payment penalties, prepayment penalties or other miscellaneous costs that are charged by lenders.

The repayment schedule is also an essential piece of information included in the statement – it outlines when payments are due and how much should be paid each time.

Borrowers can find detailed information about their rights and obligations under state and federal laws regarding loans in this document. Lenders must provide clear instructions on how consumers can raise concerns or complaints if they arise during their lending process.

When is a Loan Disclosure Statement Required?

When you are looking to take out a loan, it is crucial that you understand all the terms and conditions associated with it. This is where a Loan Disclosure Statement comes in handy. But when exactly is this document required?

In general, lenders are legally obligated to provide borrowers with a Loan Disclosure Statement before finalizing any loan agreements. The statement should contain all the relevant information about the loan, such as interest rates, fees, repayment terms and any other charges or penalties.

The purpose of providing this statement is to ensure that borrowers fully comprehend what they are getting themselves into before signing on the dotted line. Without understanding these critical details, borrowers may find themselves stuck with unfavorable loan terms or even in financial trouble down the road.

It’s important to note that different types of loans may have varying requirements for when a Loan must be provided. For instance, mortgages require disclosure at least three days before closing while car loans need disclosure within three business days after approval.

How to Get a Loan Disclosure Statement

When you apply for a loan, your lender is required by law to provide you with a Disclosure Statement. But how do you obtain this important document?

Firstly, make sure that you ask your lender for the Loan Disclosure Statement during the application process. They should be able to provide it to you without any issues.

If your lender does not give you the statement or if they are hesitant about providing it, remind them of their legal obligation and demand that they comply.

Additionally, some lenders offer online applications where borrowers can access their Loan Disclosure Statements electronically. If this is an option provided by your lender, take advantage of it as it can save time and hassle.

Remember that timing is everything when it comes to obtaining a Loan Statement. You should receive the document no later than three days after submitting your loan application. If more than three days have passed since applying and you still haven’t received the statement, contact your lender immediately.

Getting a Loan Statement isn’t difficult but requires diligence on behalf of both borrower and lender to ensure compliance with regulations. Read more…

Conclusion

What A loan disclosure statement is an important document that provides borrowers with all the necessary information about their loan. It outlines the terms of the loan, including interest rates, fees, and repayment schedules.

Remember that a loan disclosure protects both lenders and borrowers by providing transparency in lending practices. If you have any questions or concerns about your loan agreement or need help obtaining a copy of your loan disclosure statement, reach out to your lender for assistance.

By understanding what a loan disclosure statement is and why it’s important, borrowers can make more informed decisions when taking out loans and avoid being caught off guard by hidden fees or unexpected charges down the line.