What Is the Average Interest Rate for a Personal Loan?

Personal loans have become increasingly popular in today’s financial landscape for various purposes, such as debt consolidation, home improvements, or unexpected expenses. However, one critical factor that potential borrowers must consider is the interest rate associated with these loans. The average interest rate for a personal loan can vary significantly based on several factors. This article will delve into the intricacies of what is the average interest rate for a personal loan, helping you understand what to expect when seeking financial assistance through this avenue.

Understanding what is the average interest rate for a personal loan

Before we dive into interest rates, let’s establish what personal loans are. A personal loan is an unsecured loan that allows individuals to borrow a lump sum of money from a bank, credit union, or online lender. Unlike secured loans, such as mortgages or auto loans, personal loans do not require collateral.

The Factors that Influence Interest Rates

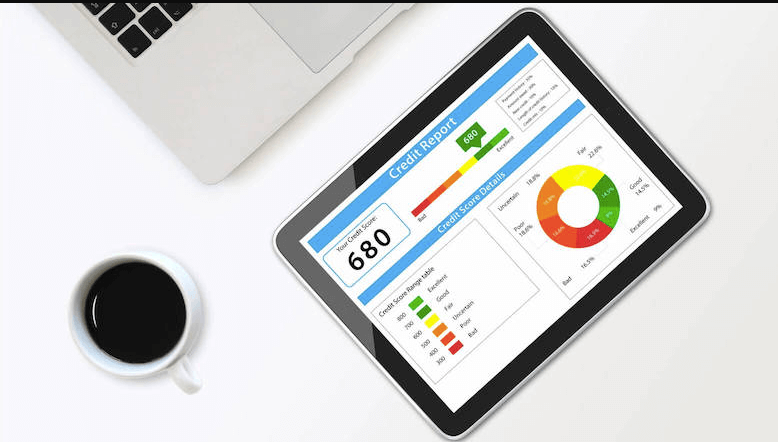

1. Credit Score

The interest rate you’ll be offered. Lenders use this three-digit number to assess your creditworthiness.

2. Loan Amount and Term

The loan amount and the loan term can also impact your interest rate. Generally, smaller loan amounts with shorter terms tend to have lower interest rates. Conversely, larger loans with longer repayment periods may come with higher interest rates.

3. Lender’s Policies

Different lenders have varying policies when it comes to personal loan interest rates. It’s essential to shop around and compare offers from different financial institutions to find the most competitive rate.

Types of Interest Rates

1. Variable Interest Rate

A variable interest rate can fluctuate based on changes in a benchmark interest rate, such as the Prime Rate. While initial rates may be lower, they can increase over time, potentially leading to higher monthly payments.

Average Interest Rates in the Market

The average interest rate for a personal loan year to year. As of the latest data available, the average interest rate for personal loans in the United States falls between 6% and 36%. However, it’s crucial to note that your specific rate may differ based on your individual circumstances.

How to Secure a Lower Interest Rate

1. Improve Your Credit Score

To secure a lower interest rate, debts, and disputing any errors on your credit report.

2. Shop Around

Don’t settle for the first offer you receive. From different lenders to find the best deal that suits your needs.

3. Consider a Cosigner

If your credit isn’t stellar, you might consider having a cosigner with a strong credit history. This can increase your chances of securing a lower interest rate. Read more…

Conclusion

In conclusion, the what is the average interest rate for a personal loan is influenced by various factors, including the lender’s policies. By understanding securing a more favorable interest rate. Always remember to shop around for the best deal and consider the type of interest rate that aligns with your financial goals and risk tolerance.

FAQs

1. Are personal loan interest rates negotiable?

Yes, personal loan interest rates can be negotiable. It’s worth discussing your financial situation with the lender and exploring options for a lower rate.

2. Can I get a personal loan with a bad credit score?

While securing a personal loan with a low credit score may be more challenging, some lenders specialize in loans for individuals with less-than-perfect credit. Be prepared for higher interest rates in such cases.

3. How often do personal loan interest rates change?

Depending on the loan agreement terms and market conditions, variable interest rates on personal loans can change periodically.

4. Are there any fees associated with personal loans?

Yes, personal loans may come with fees such as origination fees or prepayment penalties. It’s essential to read the terms and conditions of the loan agreement carefully to understand all associated costs.

5. What is the typical repayment period for a personal loan?

Personal loan repayment periods typically range from one to seven years, but the specific term depends on the lender and the borrower’s preferences.