What Is the Average Interest Rate on a Credit Card?

In today’s financially interconnected world, credit cards have become an integral part of our daily lives. They offer convenience, security, and flexibility in managing our finances. However, it’s crucial to understand the implications of credit card usage, and one of the most significant factors is the interest rate applied to these cards. In this article, we will delve into the world of what is the average interest rate on a credit card, focusing on the average rates, their impact, and how they are determined.

What Are Credit Card Interest Rates?

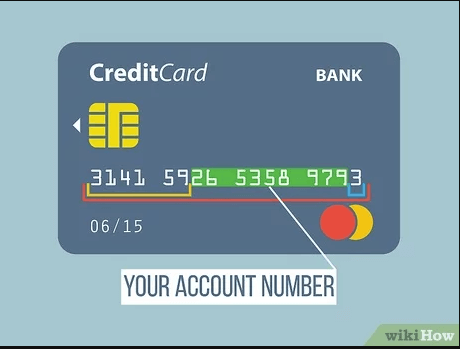

Credit card interest rates, also known as the annual percentage rate (APR), represent the cost of borrowing money when you carry a balance on your credit card. It’s essentially the fee charged by the credit card company for the convenience of purchasing items with the promise of repayment over time. These rates are expressed as a percentage and can significantly impact your financial well-being.

The Impact of Credit Card Interest Rates

Credit card interest rates can have a profound impact on your financial health. When you carry a balance on your card, the interest begins to accrue, increasing your overall debt. High-interest rates can lead to a vicious cycle of debt, making it challenging to pay off what you owe. On the other hand, low-interest rates can make borrowing more affordable, allowing you to manage your finances more effectively.

How Credit Card Interest Rates Are Determined

Credit card interest rates are not fixed and can vary from one card to another. Several factors influence the determination of these rates:

- Market Conditions: The overall economic conditions and fluctuations in the financial markets can affect credit card interest rates.

- Creditworthiness: Your credit score plays a significant role in determining the interest rate you are offered. Individuals with higher credit scores typically receive lower interest rates.

- Credit Card Type: Different credit cards, such as rewards cards or secured cards, may have varying interest rates.

- Card Issuer: Different credit card issuers may have their own pricing strategies, resulting in varying interest rates.

Average Interest Rates on Credit Cards

So, what is the average interest rate on a credit card? The average APR for credit cards typically ranges from 15% to 20%. However, it’s essential to note that this figure can change over time due to market fluctuations and economic conditions.

Historical Trends in Credit Card Interest Rates

Over the years, credit card interest rates have seen their fair share of fluctuations. During times of economic stability, rates tend to be lower, while periods of financial uncertainty can lead to higher interest rates. Keeping an eye on these trends can help you make informed decisions about your credit card usage.

Factors Influencing Credit Card Interest Rates

Apart from market conditions and credit card types, your personal financial situation can also influence the interest rate you are offered.

Credit Score and Credit Card Interest Rates

Your credit score is a significant determinant of the interest rate on your credit card. Lenders view a higher credit score as an indicator of responsible financial behavior and are more likely to offer lower interest rates to individuals with good credit.

Other Factors Affecting Credit Card Interest Rates

Other factors that can impact your credit card interest rate include your income, employment status, and the specific terms and conditions of the credit card issuer.

Managing Credit Card Interest Rates

If you’re looking to manage your credit card interest rates effectively, consider the following strategies:

Strategies to Lower Your Credit Card Interest Rates

- Improve Your Credit Score: Work on enhancing your credit score by making timely payments and reducing outstanding debt.

- Negotiate with Your Credit Card Issuer: In some cases, you can negotiate with your credit card company to lower your interest rate, especially if you have a good payment history.

- Transfer Balances: Consider balance transfers to cards with lower interest rates to save on finance charges. Read more…

Paying Off Credit Card Debt

The most effective way to manage credit card interest rates is to pay off your credit card balance in full each month. This way, you can avoid interest charges altogether and maintain good financial health.

Conclusion

In conclusion, understanding the average interest rate on a credit card is essential for responsible financial management. These rates can vary based on a variety of factors, including market conditions, creditworthiness, and card issuer policies. By staying informed and taking steps to manage your credit card interest rates effectively, you can make the most of your credit cards while avoiding unnecessary debt.

FAQs

1. What is the current average interest rate on credit cards?

The average interest rate on credit cards can vary, but it typically falls in the range of 15% to 20%. It’s important to check with your credit card issuer for the most up-to-date rates.

2. How can I lower the interest rate on my credit card?

You can lower your credit card interest rate by improving your credit score, negotiating with your credit card issuer, or considering balance transfers to cards with lower rates.

3. Are there credit cards with fixed interest rates?

Some credit cards offer fixed interest rates, which do not change over time. However, most credit cards have variable interest rates that can fluctuate with market conditions.

4. What’s the impact of a high-interest rate on my credit card?

A high-interest rate on your credit card can lead to increased finance charges and make it more challenging to pay off your balance. It’s essential to manage your credit card interest rates effectively to avoid unnecessary debt.

5. How often do credit card interest rates change?

Credit card interest rates can change periodically, depending on market conditions and the policies of the credit card issuer. It’s advisable to review your credit card terms regularly to stay informed about any rate changes.