What Is the Best Credit Card with the Lowest Interest Rate

In today’s fast-paced financial landscape, choosing the right credit card is crucial for managing your finances wisely. One of the key factors to consider when selecting a credit card is the interest rate it offers. In this comprehensive guide, we’ll delve into the intricacies of what is the best credit card with the lowest interest rate, factors influencing them, and how to find that suits your needs.

Understanding what is the best credit card with the lowest interest rate

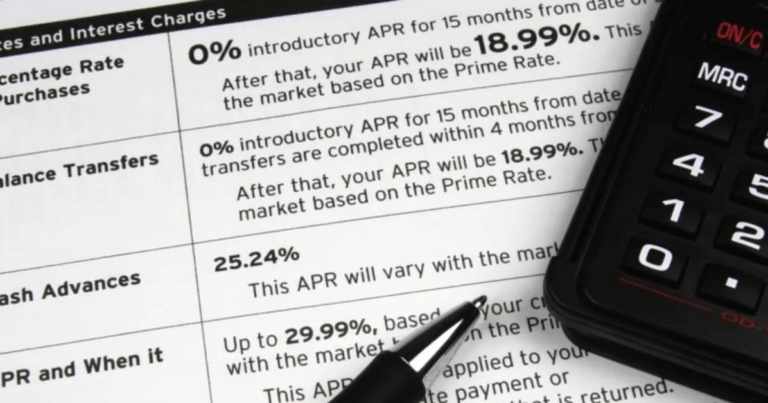

Credit card interest rates are often expressed as the Annual Percentage Rate (APR). It’s essential to comprehend the various types of interest rates associated with credit cards, including fixed rates, variable rates, and introductory rates.

Factors Influencing Interest Rates

We’ll explore how credit card issuers assess creditworthiness and how factors like introductory rates and promotional periods can impact your overall interest costs.

Comparison of Credit Cards

To find the best credit card, we’ll conduct a thorough review of different credit cards available in the market. Analyzing interest rates, fees, rewards, and additional perks will be instrumental in making an informed decision.

Tips for Finding the Best Credit Card

We’ll provide practical tips on assessing your spending habits, researching and comparing credit card offers, and understanding the fine print before making a decision.

Case Studies

Real-life case studies will highlight how individuals have benefited from low-interest credit cards. By sharing success stories, we aim to provide readers with valuable insights into the positive impact of choosing the right credit card.

Common Misconceptions

We’ll debunk common myths surrounding low-interest credit cards, clarifying misunderstandings about interest rates and addressing preconceived notions that may hinder informed decision-making.

Risks and Considerations

While low-interest credit cards offer advantages, it’s essential to be aware of potential drawbacks. We’ll discuss the risks and considerations associated with these cards, helping readers make balanced choices.

Applying for a Credit Card

A step-by-step guide to the credit card application process will be provided, along with factors to consider when submitting an application. This section aims to demystify the application process and empower readers to navigate it with confidence.

Alternatives to Credit Cards

For those exploring alternatives, we’ll discuss other financial options with lower interest rates. We’ll weigh the pros and cons of alternative financing methods, providing a comprehensive view of available choices.

Managing Credit Responsibly

This section will offer practical tips for responsible credit card usage, helping readers avoid common pitfalls and financial traps that can arise when managing credit.

Staying Informed

Regularly reviewing credit card terms and policies is essential. We’ll guide readers on how to stay informed about changes in interest rates and offers, enabling them to adapt to evolving financial landscapes. Read more…

Testimonials

Personal testimonials will round off our exploration, providing readers with relatable experiences and insights from individuals who successfully found the best credit card with a low interest rate.

Conclusion

Choosing the what is the best credit card with the lowest interest rate is a significant financial decision. By understanding the nuances of interest rates, comparing credit cards, and following practical tips, readers can make informed choices that align with their financial goals.

FAQs

Q: How do I know if a credit card has a low-interest rate?

- A: Check the card’s APR, and compare it with other options in the market. Lower APRs generally indicate lower interest rates.

Q: Can my credit score change the interest rate on an existing credit card?

- A: Yes, credit card issuers may adjust your interest rate based on changes in your credit score and overall creditworthiness.

Q: Are there any hidden fees associated with low-interest credit cards?

- A: While low-interest cards may have fewer fees, it’s crucial to review the terms and conditions for any potential hidden charges.

Q: What steps can I take to improve my credit score and qualify for a lower interest rate?

- A: Paying bills on time, reducing credit card balances, and addressing inaccuracies on your credit report can positively impact your credit score.

Q: Is it advisable to transfer balances to a low-interest credit card for better financial management?

- A: Transferring balances to a low-interest card can be beneficial, but consider any balance transfer fees and the impact on your overall financial strategy.